In 2025, efficient financial planning is crucial for creating a successful blog. Developing a well-crafted blog budget is essential in order to effectively allocate resources and maximize your blog’s potential.

In this article, we will explore the importance of creating a blog budget and provide you with tips and tricks to streamline your financial planning process.

Creating a blog budget is crucial for efficient financial planning in 2025. By setting a budget, you can effectively manage your blogging expenses and allocate resources wisely. Here are 6 key takeaways to keep in mind:

- Understand your blogging goals: Determine your objectives to allocate resources accordingly.

- Analyze your expenses: Take a close look at your blogging expenses to identify areas where you can cut back if needed.

- Prioritize your spending: Allocate funds to areas that will have the most impact on your blog’s success.

- Research and compare prices: When investing in services or tools, do thorough research and compare prices for the best deals.

- Budget for future growth: Set aside funds for future expansion as your blog grows.

- Regularly review and adjust: Continuously monitor your budget and make adjustments as needed to ensure effective financial planning.

By following these tips, you can create a blog budget that helps you manage your finances efficiently and achieve your blogging goals in 2025.

The Importance of Creating a Blog Budget

1. Financial Stability: By creating a blog budget, you can gain a clear understanding of your blog’s financial needs and ensure that you have the necessary resources to sustain and grow your online presence.

2. Resource Allocation: A blog budget allows you to allocate your financial resources efficiently. By prioritizing expenses and setting spending limits, you can make informed decisions regarding investments in content creation, marketing, and website management.

3. Goal Setting and Evaluation: A blog budget provides a framework for setting financial goals and evaluating your blog’s performance. With a clear budget in place, you can track your income and expenses, measure your return on investment, and make adjustments as necessary.

4. Financial Planning: Creating a blog budget is an integral part of your overall financial planning. It allows you to forecast future expenses and income, anticipate potential challenges, and make strategic decisions to ensure the long-term success of your blog.

5. Decision Making: A blog budget serves as a guide for making informed financial decisions. It helps you prioritize investments, evaluate the feasibility of new projects, and avoid overspending.

By recognizing the importance of creating a blog budget and implementing effective financial planning strategies, you can optimize your resources, minimize financial risks, and position your blog for long-term success in 2025.

Analyzing Income for Your Blog

In 2025, creating a budget for your blog is essential for efficient financial planning. It helps you track your income and expenses, and ensures that you’re making smart financial decisions to support your blogging goals. Here are some tips and tricks to help you create a blog budget that works for you:

Sources of Income for Bloggers

When analyzing your blog income, it’s important to consider the various sources that can contribute to your earnings. These may include:

- Advertising Revenue: This can be generated through display ads, sponsored content, affiliate marketing, or partnerships with brands.

- Product Sales: If you offer products such as e-books, online courses, or merchandise, these can be additional sources of income.

- Sponsored Posts: Brands may pay you to create content that promotes their products or services.

- Subscription Services: If you offer premium content or membership plans, these can generate recurring income.

- Freelance Services: Utilizing your blogging skills, you can offer freelance services such as writing, consulting, or social media management.

Calculating and Projecting Blog Income

To create an accurate blog budget, you need to calculate and project your blog income.

Here’s a step-by-step process:

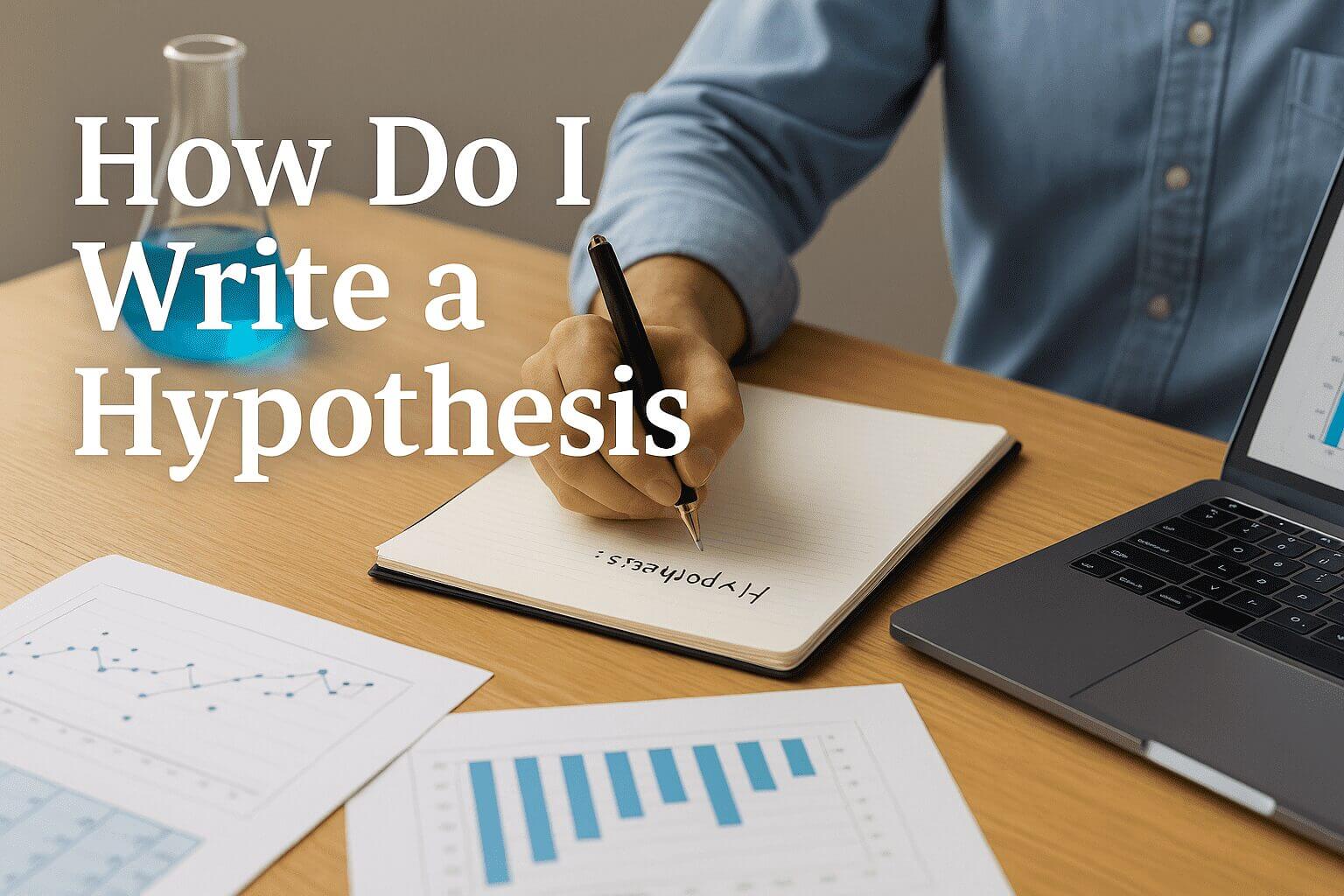

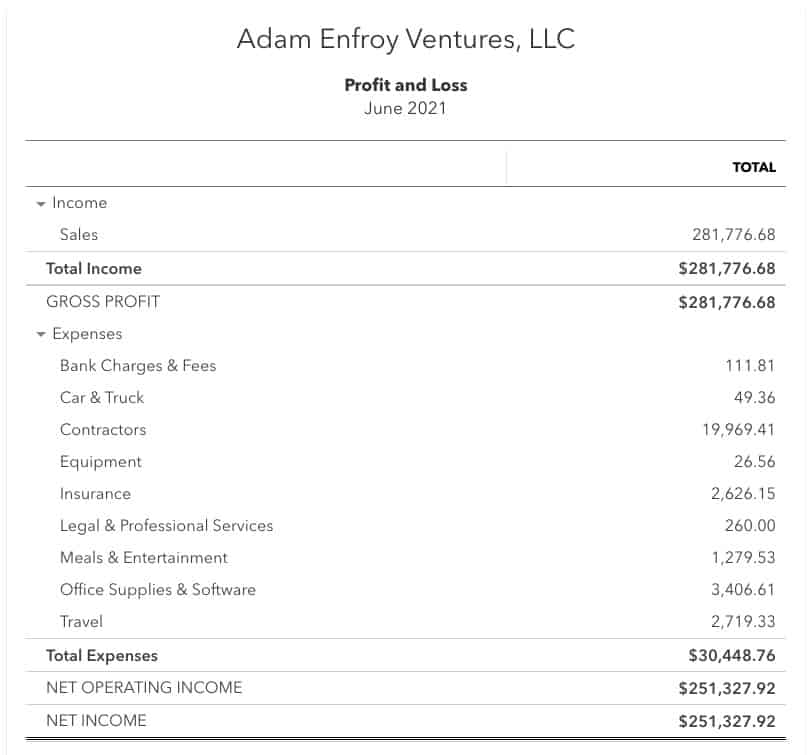

- Analyze Past Income: Review your income statements from the previous year to understand how much you earned from each income source.

- Identify Growth Opportunities: Look for areas where you can potentially increase your blog income. For example, you can focus on increasing your website traffic, negotiating higher rates for sponsored posts, or launching new products.

- Set Realistic Goals: Based on your analysis, set realistic income goals for the current year. These goals should consider the growth opportunities you identified and align with your overall blogging strategy.

- Track Your Income: Implement a system to track your blog income on a monthly or quarterly basis. This will help you stay organized and monitor your progress towards your income goals.

- Adjust and Evaluate: Regularly review and adjust your blog budget based on actual income and expenses. This will allow you to make informed decisions and optimize your financial planning.

By analyzing your blog income and creating a budget, you can effectively manage your finances and work towards achieving your blogging goals in 2025.

Determining Expenses for Your Blog

Creating a budget for your blog is crucial for efficient financial planning in 2025. By tracking and managing your expenses, you can ensure that your blog stays on track and you have a clear understanding of your financial situation. Here are some tips and tricks for creating a blog budget:

Costs Associated with Blogging

When creating a blog budget, it’s important to consider all the costs associated with running a blog. This includes expenses such as:

- Hosting fees: The cost of hosting your blog on a platform or server.

- Domain name: The fee for registering and renewing your blog’s domain name.

- Website design: The cost of themes, templates, or hiring a designer for your blog’s visual appearance.

- Plugins and tools: The cost of using plugins or tools to enhance your blog’s functionality.

- Content creation: The cost of hiring writers, photographers, or graphic designers for your blog’s content.

- Marketing and advertising: The cost of promoting your blog through online ads or social media campaigns.

- Maintenance and updates: The cost of regular maintenance, updates, and security measures for your blog.

- Education and resources: The cost of courses, books, or subscriptions to improve your blogging skills.

Tracking and Budgeting Blog Expenses

To efficiently plan your blog budget, it’s crucial to track and categorize your expenses. Here are some tips to help you with this process:

- Keep records: Maintain a spreadsheet or use budgeting software to track your blog-related expenses.

- Categorize expenses: Divide your expenses into categories such as hosting, marketing, content creation, etc.

- Set budget limits: Determine a monthly or yearly budget for each expense category based on your financial goals.

- Prioritize essential expenses: Allocate more funds to essential expenses like hosting and content creation.

- Identify cost-saving opportunities: Look for ways to cut costs, such as finding affordable hosting plans or using free tools and resources.

- Revisit and adjust: Regularly review your budget and make adjustments as needed to accommodate changes in your blogging activities or financial situation.

Creating a blog budget allows you to effectively manage your finances and make informed decisions regarding your blog’s growth and profitability. By tracking expenses and setting budget limits, you can ensure that your blog remains financially sustainable in 2025.

Now, let’s dive deeper into the topic of creating a blog budget and explore more specific tips and tricks for efficient financial planning in the upcoming year.

Setting Financial Goals for Your Blog

Creating a successful blog requires efficient financial planning to ensure its sustainability and growth. In 2025, it’s essential to have a clear budget in place to manage expenses and allocate resources effectively. Here are some tips and tricks to help you create a blog budget that works for you.

Defining Short-term and Long-term Goals

Short-term goals are immediate financial milestones that you want to achieve within a year or less, such as investing in website design or purchasing necessary equipment.

Long-term goals are those that require more time and planning, such as expanding your blog’s reach or monetizing it through partnerships or advertising.

To set effective goals, consider the following:

- Assess your current financial situation and identify areas where you can save or redirect funds.

- Prioritize your goals based on their importance and feasibility.

- Set specific and measurable targets to track your progress.

- Adapt your goals as your blog grows and evolves.

Creating a Plan to Achieve Financial Milestones

Once you have defined your goals, it’s time to create a comprehensive plan to achieve them. Here are some steps to consider:

- Track your expenses: Monitor your income and expenses to understand your spending habits and find areas where you can cut costs.

- Create a monthly budget: Allocate funds for essential expenses, such as hosting fees and content creation, as well as savings for future investments.

- Explore monetization strategies: Research different methods to earn revenue from your blog, such as affiliate marketing, sponsored content, or selling digital products.

- Establish an emergency fund: Set aside funds to handle unexpected expenses or periods of low income.

- Invest in your blog: Allocate a portion of your budget for strategic investments that can enhance your blog’s quality, reach, and user experience.

- Regularly review and adjust: Revisit your budget and goals periodically to ensure they align with your blog’s growth and financial capabilities.

By following these tips and tricks, you can create a blog budget that allows you to manage your finances efficiently and achieve your financial milestones in 2025.

Allocating Funds for Marketing and Promotion

As a marketing professional, it is crucial to create a solid blog budget for efficient financial planning in 2025. Allocating funds wisely ensures that you can effectively promote your brand, products, or services while maximizing return on investment. Here are some tips and tricks for creating an efficient blog budget:

Budgeting for Advertising and Promotion

1. Determine your business goals: Clearly define your marketing objectives to set a budget that aligns with your goals. Whether it’s increasing brand awareness, driving website traffic, or generating leads, setting specific targets will guide your budget allocation.

2. Understand your target audience: Research and analyze your target audience’s preferences and behavior to identify the most effective advertising and promotion channels. Invest in high-return channels, such as SEO, PPC, social media marketing, and email marketing, to reach and engage your audience effectively.

3. Track and analyze campaign performance: Regularly monitor and evaluate the performance of your marketing campaigns to identify areas of improvement and allocate budget accordingly. Tracking leads generated, conversion rates, and return on investment (ROI) will help you optimize your budget allocation.

Strategies to Maximize Return on Investment

1. Focus on data-driven optimization: Utilize data and analytics tools to gain insights into your audience’s behavior and preferences. Use this information to optimize your campaigns for better results and efficient budget allocation.

2. Allocate budget for customer retention: While attracting new customers is important, don’t overlook the significance of customer retention. Allocate a portion of your budget for strategies that nurture and retain existing customers, such as loyalty programs, personalized email campaigns, or customer service enhancements.

3. Adapt to changing market trends: Stay updated with the latest market trends and consumer behavior shifts. Adjust your budget allocation to incorporate emerging channels or technologies that can better reach your target audience and drive results.

Creating a blog budget requires careful planning and strategic allocation of funds. By following these tips and tricks, you can ensure efficient financial planning in 2023 and maximize the impact of your marketing efforts.

For more information on marketing budget planning, you can refer to Wikipedia’s article on marketing budget.

Investing in Blog Tools and Resources

As a blogger in 2025, it’s important to have a well-planned budget for your blog. Allocating funds to the right tools and resources can significantly improve your efficiency and overall success. Here are some key tips and tricks for creating an efficient financial plan for your blog:

- Research and prioritize: Start by identifying the essential tools and resources you need for your blog, such as hosting services, website themes, and plugins. Prioritize these based on their importance and impact on your blog’s performance.

- Compare prices and features: Take the time to research different providers and compare their prices and features. Look for discounts and promotions that can help you save money while still getting the necessary tools for your blog.

- Consider open-source options: Open-source software and platforms, such as WordPress, offer a wide range of features and customization options at no cost. Explore these options before investing in paid tools to see if they meet your needs.

- Take advantage of free resources: Many online platforms and communities offer free resources, such as templates, tutorials, and educational materials, that can enhance your blogging experience without breaking the bank.

Budgeting for Blogging Software and Services

WordPress: WordPress is a popular content management system that powers millions of websites worldwide. It offers both free and premium plans, allowing you to choose the features that best suit your blog’s needs.

Grammarly: Grammarly is an AI-based writing assistant that helps you improve your writing skills and eliminate grammatical errors. It offers a free version with basic features and a premium version with advanced functionalities.

Canva: Canva is a graphic design platform that enables bloggers to create visually appealing images for their blog posts and social media. It offers a free version with limited features and a paid version with more design options.

Ahrefs: Ahrefs is a comprehensive SEO tool that helps you analyze your website’s performance, track keywords, and optimize your content. It offers different pricing plans based on the features you need for your blog.

Remember, budgeting for your blog is an ongoing process. Regularly review and adjust your budget based on your blog’s growth and changing needs. By investing wisely in the right tools and resources, you can optimize your blog’s performance and achieve your goals in 2025.

Tracking and Evaluating Budget Performance

Creating a blog budget is crucial for efficient financial planning in 2025. To ensure effective budget management, it is important to track and evaluate the performance of your blog budget.

By monitoring income and expenses, you can identify areas where costs can be reduced and adjust your budget accordingly. Implementing a rolling forecast and budgeting approach can help align your budget with your business goals and improve the accuracy of your projections.

Identifying Areas for Improvement and Adjustment

Regularly reviewing and evaluating your blog budget allows you to identify areas for improvement and adjustment. By analyzing past performance and comparing it to your budget estimates, you can refine your budgeting processes and make informed decisions for future budget planning.

Additionally, involving stakeholders in the budgeting process can provide valuable insights and enhance collaboration. With continuous monitoring and evaluation, you can ensure that your blog budget is optimized for efficient financial planning in 2025.

Conclusion

As someone who has been blogging for years, I understand the importance of creating a blog budget for efficient financial planning in 2025.

It’s essential to set a budget and stick to it to avoid overspending and manage your blogging expenses effectively. Here are some key takeaways and tips for creating a blog budget:

- Identify your blogging goals: Before creating a budget, determine your blogging goals and objectives. Are you looking to monetize your blog or simply share your thoughts and experiences? Knowing your goals will help you allocate your resources accordingly.

- Analyze your expenses: Take a close look at your blogging expenses, including web hosting, domain registration, design and development, content creation, marketing, and other costs. This will help you understand where your money is going and identify areas where you can cut back if needed.

- Prioritize your spending: Once you have a clear understanding of your expenses, prioritize your spending based on your goals and what will have the most impact on your blog’s success. Allocate your funds to areas that will yield the highest return on investment.

- Research and compare prices: When investing in services or tools for your blog, do thorough research and compare prices. Look for the best deals and discounts, but also consider the quality and reliability of the products or services you are purchasing.

- Budget for future growth: As your blog grows, your expenses may increase. Plan for future growth by setting aside a portion of your budget for expansion, such as upgrading your hosting plan, investing in marketing campaigns, or hiring freelancers for content creation.

Creating a blog budget requires careful consideration and planning. By following these tips and staying disciplined with your expenses, you can effectively manage your finances and set yourself up for success in the blogging world. Remember, financial planning is a continuous process, so regularly review and adjust your budget as needed. Happy blogging!